Important Ideas

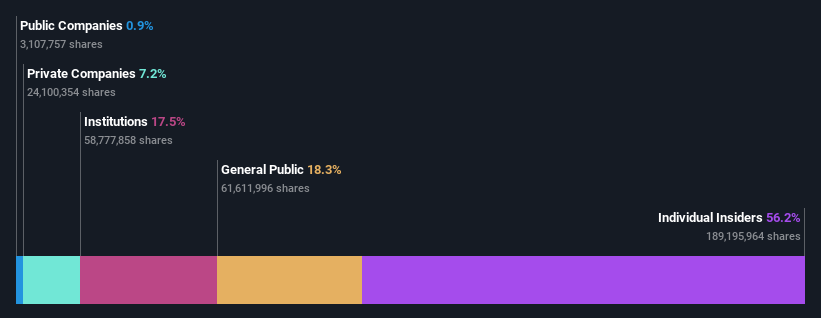

If you want to know who really controls Ainsworth Game Technology Limited (ASX: AGI), you’ll have to look at the structure of its share register. At 56%, insiders own the most shares in the company. That is, the group will benefit the most if the stock goes up (or lose the most if there is a drop).

And last week, insiders endured the biggest losses as the stock fell 14%.

In the chart below, we zoom in on the different ownership groups of Ainsworth Game Technology.

Check out our latest review for Ainsworth Game Technology

What Are Owners Telling Us About Ainsworth Sports Technology?

Institutional investors often compare their returns to the returns of a commonly tracked index. So they generally consider buying larger companies that are included in the relevant benchmark index.

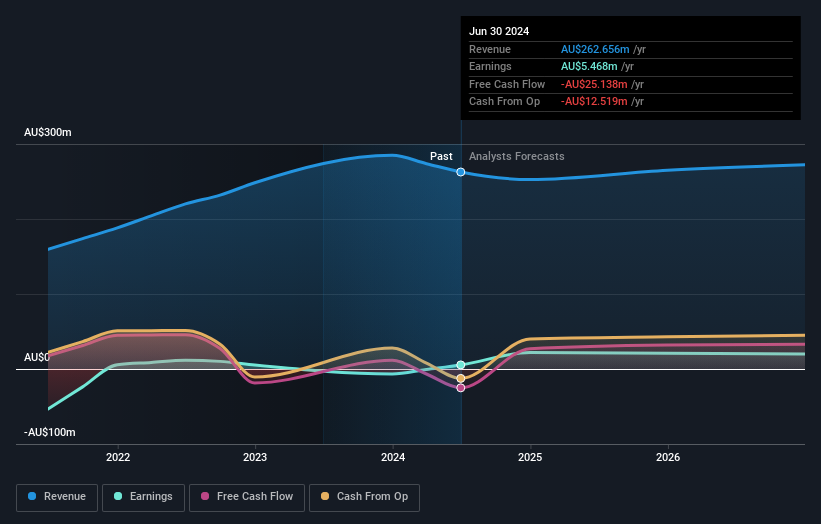

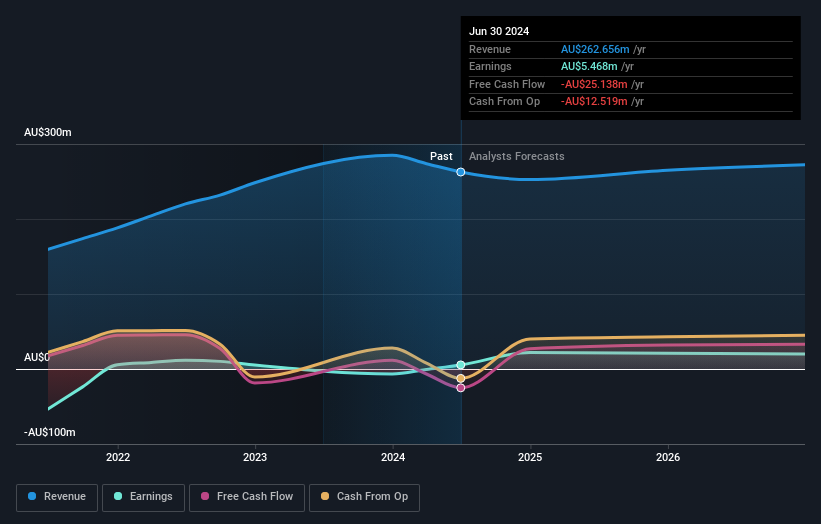

Ainsworth Game Technology already has registered centers for the feature. Indeed, they have a respectable role in the company. This can show that the company has a certain degree of credibility in the investment community. However, it is better to be careful to rely on the evidence that is said to come with institutional investors. They, too, make mistakes sometimes. When many institutions own property, there is always the risk that they are in a ‘crowded business’. When such a business does not go well, many parties can compete to sell the property quickly. This risk is higher for a company with no history of growth. You can see Ainsworth Game Technology’s historical earnings and revenue below, but remember there’s more to the story.

Ainsworth Game Technology is not owned by hedge funds. Johann Graf is currently the largest shareholder of the company with 53% of the outstanding shares. This means they have significant influence, if not direct control, over the future of the organization. Spheria Asset Management Pty Ltd is the second largest shareholder with 8.2% of the common stock, and Allan Gray Proprietary Ltd. owns about 4.6% of the company’s stock.

Researching institutional ownership is a good way to gauge and filter a stock’s expected performance. The same can be achieved by studying the opinions of critics. Despite the news about the analysts, the company is probably not covered much. So it can get more attention, down the track.

BIBLE SCRIPTURES VERSE OF THE DAY Ainsworth Game Technology

The definition of an insider can vary slightly between different countries, but board members always count. The management of the company runs the business, but the CEO will answer to the board, even if he is a member of it.

I generally consider insider ownership to be a good thing. However, sometimes it is difficult for others to hold the board accountable for decisions.

It appears that insiders own more than half the stock of Ainsworth Game Technology Limited. This gives them a lot of power. So they have a share of AU$142m in this AU$253m business. It is good to see this level of investment. You can check here to see if insiders are buying recently.

Public Authority in General

The general public — including retail investors — has an 18% stake in the company, so it’s not easy to ignore. Although this group will not be able to make calls, they can certainly have a real impact on how the company is run.

Ownership of a Private Company

We see that Private Companies have 7.2% of the shares that appear in this matter. It is difficult to draw conclusions from this point alone, therefore, it is important to look at who owns those private companies. Sometimes insiders or other related parties have an interest in shares of a public company through a private limited company.

Next Steps:

Although it is good to think about the different groups that have a company, there are other factors that are more important. For example, we found 1 warning sign for Ainsworth Game Technology What you should consider before investing here.

Finally the future is the most important. You can access this for free report on the auditor’s estimates for the company.

NB: The figures in this article are calculated using data for the last twelve months, which refers to the 12 month period ending on the last day of the month the financial statement is written. This may contradict the figures in the full year report.

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide opinions based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not cover recent releases that are not sensitive to pricing or quality materials. Simply Wall St has no position in the stocks mentioned.

#pullback #hurt #insiders #Ainsworth #Game #Technology #Limited #ASX #AGI